The Big Four

Tenants who have a bad rental history or a criminal history need a place to live just like everyone else. These characters know they can’t rent from large, well managed apartment communities because they check references. So, who are they looking for? They are looking for a nice, private landlord who thinks he’s is a good judge of character.

Would you like to avoid these characters? It’s simple. Just remember the “Big Four”: Income to rent ratio, Criminal, Rental, and, Credit History.

First, it’s important to have the right mindset when considering a new rental applicant. Think of it as granting a huge loan to a total stranger with little or no collateral; and, the only information you have is from the applicant himself.

1. Income to rent ratio

This is the first question to ask because if they don't make enough money there is no reason to continue with the interview. Rent and utilities should be less than one third of the total family income after taxes. Verify income the same way your banker did when you financed the property: get a pay stub or the last three months of bank statements. If they don’t have deposits at least equal to their stated income you should find out why.

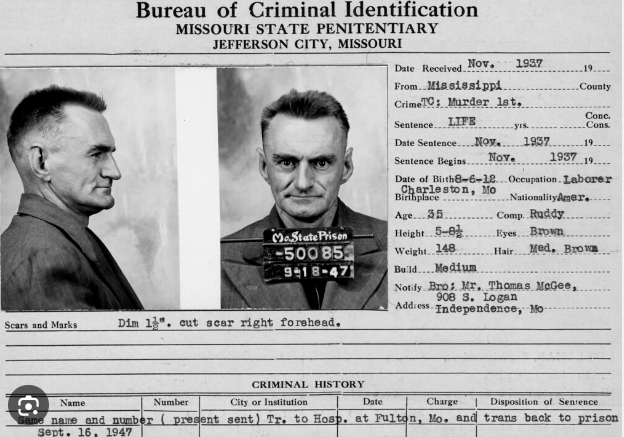

2. Criminal History

Here's a great question to address this often sensitive area: "Have you ever been in the back seat of a Police car"? It's up to you to establish your policy here. Do it and stick to it. A common company policy regarding criminal history is: no felony convictions in the past seven years and no sexual offenses ever. It is frightening how many landlords skip right past this and in the process rent to potentially dangerous people. Think about this: every dangerous criminal who is not in jail is renting a place to live. Do you want one in your home?

3. Rental History

Who knows better what your experience is likely to be with the potential renter than the previous landlord. Honestly, why not ask every previous landlord about their experience with the applicant? The phone call is free and you have thousands of dollars at stake! Here’s a good tip. Check the Property Appraiser’s website to verify the name of the owner. Does it match the name the applicant gave you?

4. Credit History

This can be difficult to nail down as a written policy because credit history has subjective factors which go beyond the credit score. How has he treated previous Creditors? Do you want to be the next Creditor added to his Credit Report? In general credit history should reflect appropriate care and concern for all financial obligations.

So, if you get all green lights to the Big Four, pull out the lease, collect the rent, security deposit, and application fees but don't give them the keys. Then verify everything. It's simple. We call it "Trust but verify".

###

Paul Howard is President of The Florida Landlord Network.

You can contact him via email at: Paul@FlaLandlord.com

or visit the website at: www.FlaLandlord.Com.

Feedback, Questions, Opinion

We will get back to you as soon as possible.

Please try again later.

All text and images on this page are Copyright© Florida Landlord Network, 2012.