A Warning To Landlords!

Remember Landlords: You have an obligation to inform rental applicants of their rights regarding consumer reports.

Recently, The United States Department of Housing and Urban Development, the Federal Housing Finance Agency, and the United States Department of Agriculture (that's three separate Federal Agencies - It must be important!) are reminding landlords of their obligation to inform tenants and prospective tenants of their rights with respect to use information from a consumer report, like a rental background check. The Fair Credit Reporting Act requires landlords to tell the tenant of their decision and how the tenant can contact the company that created the background check. This obligation, known as the adverse action notice requirement, applies to any action against a tenant based on information from the background check, including denying a rental application, increasing the rent charged or security deposit amount, or requiring a co-signer. As the agencies state, providing this information in writing is the best way to ensure that tenants get the information they need, and for landlords to demonstrate they are meeting their legal obligations (emphasis added). Source

Today, as I read this article, -- which included contributions from no less than three separate Federal Agencies -- I froze as I realized this looks like a subtle warning from the Federal Government of possible increased scrutiny, investigations, and consumer education activities.

Landlords need to be aware of their legal obligations under the Fair Credit Reporting Act (FCRA), and Fair Housing Act (FHA). The FHA bans discrimination based on certain "protected classes". These include Race, Color, Religion, Sex, Disability, Family Status, and National Origin. The FCRA deals with consumers rights concerning their credit reports.

In case you missed it:

This week it was announced that certain Florida consumer groups have been given grants totaling more than $850,000 to help pay for testers (Click to see Video) and other activities to, in some cases, secretly investigate your rental property operation.

The following guide focuses on the FCRA and covers the essentials you need to understand in order to correctly protect the rights of your customers and protect yourself from serious and often painful scrutiny from various Federal Agencies.

ALWAYS use a telephone script. (Click Here) This means ALWAYS say the same thing to everyone. Every conversation should be essentially the same. You should prepare your telephone pitch well in advance, in writing, memorized, and executed the same way every time.

One of the biggest mistakes you can make with a rental applicant is to say different things to different people. This can easily be interpreted as discrimination – even if you don’t have any intention to discriminate.

Also, if the Federal Government punishes you for such misdeeds, your next phone call will likely be from an attorney representing the aggrieved applicant. Since the Feds will by this time have declared you guilty, you don’t have a chance in a civil case. So, you may face heavy civil liability for which you may not have insurance coverage. Remember, their intention is to punish. This is not just a simple civil fine.

ALWAYS advise your rental applicant of your resident selection criteria. The easiest way to do this is by including your written policy in the Rental Application (Click Here) . Your policy should include:

- Application Requirements

- Total Household Income Requirements

- Credit Reporting

- Rental History

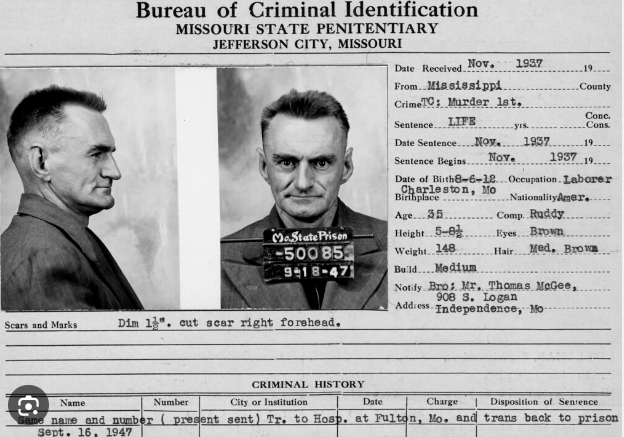

- Criminal History

- Pets Policy

- Tobacco Policy

- Occupancy Requirements

ALWAYS document your work when researching the history of a potential rental applicant. This means you should take notes of all interviews with the applicant, whether on the phone or in person. Save all emails and text messages. Carefully document phone conversations with other landlords; and avoid making notes directly on Credit Reports, etc.

It is very easy to document these things by making quick notes using a word or text processor and save them with the applicants other documents, etc.

ALWAYS provide the Applicant with the Adverse Action information.

The Applicant will experience an “Adverse Action” under FCRA if any of the following occur:

- You decline to rent to the applicant.

- You increase the rent amount above that which was advertised.

- You increase the security deposit.

- You require a co-signer.

- There may be others.

If you use the Tenant Screening system provided by Florida Landlord Network, the Adverse Action steps are a part of that process and very simple to implement. At it’s heart, you are required to advise the applicant in writing the reason(s) for the Adverse Action and the source of any information used to come to that decision. This is done with a particular letter sent to the applicant by U.S. Mail.

The moral to this story is we need to be very wise business men and women as we grow and manage our rental businesses. Our obligations to the consumers we serve and the various Federal Agencies which have jurisdiction over some of our activities must be taken very seriously.

A relatively small investment of your time, should be all it takes to be sure that you never discriminate in any way – intentionally or unintentionally.

Additional Resources:

###

Special Notice: Florida Landlord Network is an independent, non-attorney service.

We urge you to consult an attorney before using any document or described procedure found herein.

Florida Landlord Network is not licensed by the Florida Bar to practice law and is not authorized

to give legal advice or tell you your legal rights.

By using our website or any service or document produced and/or published by Florida Landlord Network,

you indicate that you understand and agree to our Legal Disclaimer.