Federal Regulations - Using Consumer Reports

As a landlord – or property manager or other housing provider – you evaluate housing applications or decide whether to renew a current tenant’s lease. You might decide to run a tenant background check using a company that compiles background information. These tenant background checks can include a variety of information, such as rental and eviction history, credit history, or criminal records.

Tenant background check reports are consumer reports. When you use consumer reports to make tenant decisions, you must comply with the Fair Credit Reporting Act (FCRA). The Federal Trade Commission (FTC) enforces the FCRA.

FCRA Basics

You must take certain steps before you can get a consumer report and after you take an adverse action based on that report.

What is a Consumer Report?

Consumer reporting agencies (CRAs) prepare consumer reports for other businesses, including landlords. A consumer report may contain information such as a person’s credit characteristics, rental history, or criminal history. These reports are covered by the FCRA. Examples of these reports include:

- A credit report from a credit bureau, such as Trans Union, Experian, and Equifax or an affiliated company;

- A report from a tenant screening company that describes the applicant’s rental history based on reports from previous landlords or housing court records;

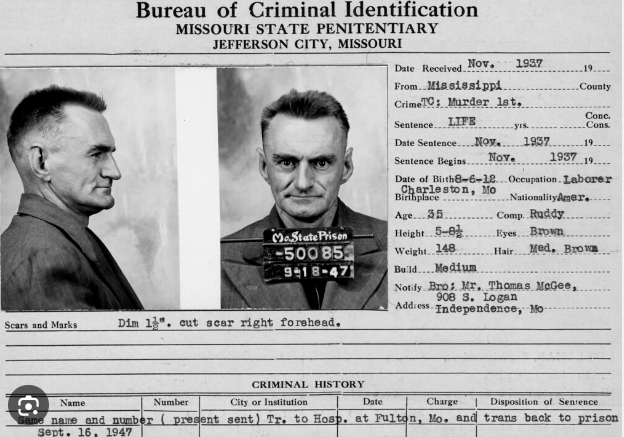

- A report from a background check company that describes the applicant’s criminal history;

- A report from a tenant screening company that describes the applicant’s rental history and criminal history, and also includes a credit report;

- A risk score or recommendation from a tenant screening company about the applicant based on criteria you’ve selected; and

- A report from a reference checking service that contacts previous landlords, employers, or other parties listed on the rental application on behalf of the rental property owner.

What is an Adverse Action?

An adverse action is any action by a landlord that is unfavorable to the interests of a rental applicant or tenant. Examples of common adverse actions by landlords include:

- Denying the application;

- Requiring a co-signer on the lease;

- Requiring a deposit that would not be required for another applicant;

- Requiring a larger deposit than might be required for another applicant; and

- Charging a higher amount for rent than for another applicant.

Complying with the FCRA

Before You Get a Consumer Report

You can only get a consumer report if you have a permissible purpose. Landlords may get consumer reports on applicants and tenants who apply to rent housing or renew a lease. You may also get written permission from applicants or tenants to show that you have a permissible purpose.

You must certify to the company from which you are getting the consumer report that you will use the report only for housing purposes. You may not use the consumer report for another purpose.

It’s also a good idea to review other applicable federal and state laws related to screening tenants. For example, a blanket policy of refusing to rent to anyone with a criminal record may violate the Fair Housing Act.

After You Take an Adverse Action

If you reject an applicant, increase the rent or deposit, require a co-signer, or take any other adverse action based partly or completely on information in a consumer report, you must give the applicant or tenant a notice of that fact in writing, electronically, or orally.

An adverse action notice tells people about their rights to see information being reported about them and to dispute inaccurate information. The notice must include:

- the name, address, and phone number of the CRA that supplied the report;

- a statement that the CRA that supplied the report did not make the decision to take the unfavorable action and can't give specific reasons for it; and

- a notice of the person’s right to dispute the accuracy or completeness of any information the CRA furnished, and to get a free report from the CRA if the person asks for it within 60 days.

The adverse action notice is required even if information in the consumer report wasn’t the primary reason for the decision. Even if the information in the report played only a small part in the overall decision, you must notify the applicant or tenant.

While oral adverse action notices are allowed under the FCRA, written notices are the best practice and benefit both you and the applicant or tenant. Written notices allow you to provide proof of FCRA compliance. Written notices also better enable applicants and tenants to assert their rights to request a copy of the report from the CRA and to dispute any errors in the report.

If you use a credit score in deciding to take an adverse action against an applicant or tenant, you have additional obligations. You must give the applicant or tenant written or electronic notice that includes the credit score, a description of the score (its source, the date it was created, and the range of scores under that credit model), and the key factors that adversely affected the credit score, listed in the order of their importance based on their effect on the credit score.

Take the case of . . .

- You order a consumer report from a CRA. Information in the report leads to further investigation of the applicant. You deny the rental application because of that investigation. You must give the applicant an adverse action notice because the information in the report prompted the adverse action in this case.

- A person with a bankruptcy on their credit report applies for an apartment. Rather than deny the application, you offer to rent the apartment but require a security deposit that is double the normal amount. You must give the applicant an adverse action notice because the credit report influenced your decision to require a higher security deposit from the applicant.

- You hire a reference checking service to verify information included on a rental application. Because the service reports that the applicant does not work for the employer listed on the application, you deny the rental application. You must give the applicant an adverse action notice. The report is a consumer report from a CRA (the agency checking the references provided by the consumer on the application), and its report influenced your decision to deny the application.

- You make it a practice to approve an application if the applicant shows an adequate income or has a favorable credit report. Because an applicant has an inadequate income and a bad credit report, you deny their application. You must give the applicant an adverse action notice because the credit report influenced the denial, even though income was another factor.

- You order an applicant’s criminal history report from a CRA. Because the report shows that the applicant has a felony conviction, you deny the rental application. You must give the applicant an adverse action notice because the report is a consumer report and it influenced your decision to deny the application.

Additional Requirements for Investigative Reports

Landlords who use “investigative reports” – reports based on personal interviews concerning a person’s character, general reputation, personal characteristics, and lifestyle – have additional obligations under the FCRA. These obligations include giving written notice that you may request or have requested an investigative consumer report and giving a statement that the person has a right to request additional disclosures and a summary of the scope and substance of the report. (See 15 U.S.C. section 1681d(a), (b)).

Disposing of Consumer Reports

When you’re done using a consumer report, you must securely dispose of the report and any information you gathered from it. That can include burning, pulverizing, or shredding paper documents and disposing of electronic information so that it can't be read or reconstructed. For more information, see Disposing of Consumer Report Information? Rule Tells How.

If You Report Information to a Consumer Reporting Agency

If you report information, like late rent payments or evictions, to a CRA, you have legal obligations under the FCRA and the FCRA’s Furnisher Rule. For more information, see Consumer Reports: What Information Furnishers Need to Know.

For More Information

Find specific FCRA information on:

- Getting consumer reports (see Section 604(a)(3)(F), 15 U.S.C. § 1681b(a)(3)(F), and Section 604(f), 15 U.S.C. § 1681b(f));

- Taking an adverse action (see Section 615(a), 15 U.S.C. § 1681m(a));

- Using investigative consumer reports (see Section 606, 15 U.S.C. § 1681d).

July 2023

Feedback, Questions, Opinion

We will get back to you as soon as possible.

Please try again later.